Frankly, the use of credit is an explosive subject.

Used wisely, it can expand a business, provide home ownership, lend you a car and send students to college.

Misused, it can ruin your financial future - and present.

Despite a very costly divorce, I have never been drowning in debt, but I have learned from watching Oprah obsessively that it is possible to reduce debt and get back on one's feet with a combination of strategies:

1) acknowledge the problem and seek help from a credit counseling service.

2) Call the credit card companies, tell them you are working to reduce your debt and ask if they can give you a lower interest rate.

3) list your debts and the interest you are paying on each one. Cut up the card w/ the highest interest rate and begin paying as much as you can to pay that one off. Or transfer that debt to another card with the lowest interest rate and begin paying as much as you can on the next highest interest card. Pay the minimums on the low interest cards and put as much as you can toward the highest rate card.

3) return whatever you can that was bought w/ a credit card.

4) sell whatever you can on EBay.

5) use cash - if you don't have it, you can't buy it.

Reducing your debt requires time and discipline, but you can do it.

Congratulations if you've kept your debt under control. I have a number of credit cards but I have 2 rules to live by:

1) never pay for the use of a credit card, and

2) don't use a card unless you are getting something back.

My Target credit card gives me 5% off all purchases @ Target. My American Express card gives me an annual check to spend at Costco. My Old Navy Visa gives me credit to use not only at Old Navy, but at the Gap, Banana Republic and my new favorite Athleta.

Most of my credit cards give a 1%, 3% or 5% credit on purchases, which I use as credit on my monthly statement. Many of the cards changed categories or percentages quarterly and it can be difficult to remember who's offering what.

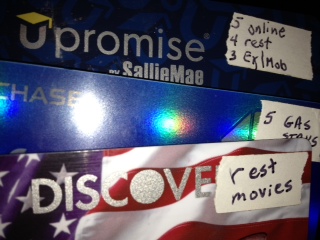

Masking tape solves the problem. A small piece of tape on the corner of the card on which you've noted the categories w/ a thin Sharpie does the trick! This works w/ gift cards, too. Just note the amount left on the card. I did this today w/ $3.40 left on a New York Times gift card. I told the cashier the exact amount left on the card and paid the rest in cash. No problem!

Next week, we'll talk about how to get up to a third more out of your every day products.

Keep calm & carry on...Lori

Used wisely, it can expand a business, provide home ownership, lend you a car and send students to college.

Misused, it can ruin your financial future - and present.

Despite a very costly divorce, I have never been drowning in debt, but I have learned from watching Oprah obsessively that it is possible to reduce debt and get back on one's feet with a combination of strategies:

1) acknowledge the problem and seek help from a credit counseling service.

2) Call the credit card companies, tell them you are working to reduce your debt and ask if they can give you a lower interest rate.

3) list your debts and the interest you are paying on each one. Cut up the card w/ the highest interest rate and begin paying as much as you can to pay that one off. Or transfer that debt to another card with the lowest interest rate and begin paying as much as you can on the next highest interest card. Pay the minimums on the low interest cards and put as much as you can toward the highest rate card.

3) return whatever you can that was bought w/ a credit card.

4) sell whatever you can on EBay.

5) use cash - if you don't have it, you can't buy it.

Reducing your debt requires time and discipline, but you can do it.

Congratulations if you've kept your debt under control. I have a number of credit cards but I have 2 rules to live by:

1) never pay for the use of a credit card, and

2) don't use a card unless you are getting something back.

My Target credit card gives me 5% off all purchases @ Target. My American Express card gives me an annual check to spend at Costco. My Old Navy Visa gives me credit to use not only at Old Navy, but at the Gap, Banana Republic and my new favorite Athleta.

Most of my credit cards give a 1%, 3% or 5% credit on purchases, which I use as credit on my monthly statement. Many of the cards changed categories or percentages quarterly and it can be difficult to remember who's offering what.

Masking tape solves the problem. A small piece of tape on the corner of the card on which you've noted the categories w/ a thin Sharpie does the trick! This works w/ gift cards, too. Just note the amount left on the card. I did this today w/ $3.40 left on a New York Times gift card. I told the cashier the exact amount left on the card and paid the rest in cash. No problem!

Next week, we'll talk about how to get up to a third more out of your every day products.

Keep calm & carry on...Lori

No comments:

Post a Comment