Eating Well - In & Out

My Dad says there are 2 kinds of people: those who eat to live and those who live to eat! Guess which one I am! I told you I'm Italian, right?

So food is much more than sustenance for me. It's comfort, decadence, seduction, nutrition, joy...this is descending into an eating disorder, so let's get to the saving money part, shall we?

Eating at home, of course, will save you the most, but we all deserve a treat now and then. It is possible to enjoy dining out - occasionally - and still send your kids to college.

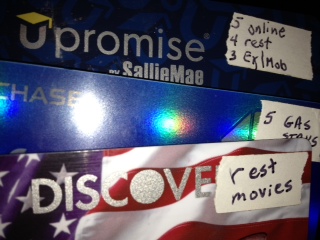

There are tons of online restaurant deals. My favorites are on Groupon and Travelzoo. I've purchased quite a number of delicious restaurant meals this way. It doesn't even take planning w/ Groupon. It has a "Now" deals section with discounts available right away. Consult your computer or smart phone and go. Everyone does this, and in my humble opinion we all need to get over feeling weird about it. The restaurants do this to get your business, so if you're there, it's a win win!

Another of my favorites is "Restaurant Week" which in reality should be called restaurant Season or restaurant Month (not that I'm complaining)! Twice a year in Manhattan, usually at the end of January/beginning of February (my birthday - yeah) and again at the end of July/beginning of August, some of the best restaurants in New York offer a limited prix fix 3 course menu. This year it is $25 lunch and $38 dinner. Frequently they offer wine specials, too.

Now, these are not restaurants we budget watchers would normally visit, but whenever I can dine at Le Cirque, or Nobu or Bar Boulud for a $38 dinner tab I'm in. I had lunch today at Lincoln and it was divine!

When the schedule is first announced, I visit Open Table and make 3 or 4 Friday night dinner reservations. My boyfriend lives in New Jersey and comes into the city most weekends. Restaurant week menus are usually not available on Saturday night (but it never hurts to ask). Then I make a birthday dinner reservation for my daughter and/or son to take Mom out. Then I call traditional working friends to see if they are available for dinner during the week. And finally, I make a few lunch reservations and check in w/ my ladies who lunch.

Open Table makes it incredibly easy. You can change or cancel a reservation and then revue the meal when you're done. You earn points for this and earn a check good at any Open Table restaurant. Last Friday evening, I took my daughter our to a wonderful new restaurant that was participating in Restaurant Week. I used my $20 Open Table check when the bill came and without drinks two 3 course meals were less than $60!

In previous years, Restaurant Week has been held in Brooklyn, Long Island and Westchester. If you live there, you might want to put a "Restaurant Week" alert on your computer or smart phone so you won't

miss it.

Once you've dined, remember to review the restaurant to build up those reward points. If you are also willing to write something for Zagat, you will get a free one of this fantastic restaurant guide, too.

During non-Restaurant Weeks, look for prix fix and stick to the menu! The beverages and coffee add up quickly. I'm addicted to seltzer, but when I eat out, it's usually tap water, please. I ask for a wedge of lemon and I'm a happy girl! Lunch is always less expensive than dinner, and many restaurants have lunch specials to lure you in at this generally less crowded time of day. So meet a friend for lunch!

At dinner, for savings and health reasons, you can frequently take half of the meal home and have it the next day for lunch. Or there is nothing wrong with ordering 2 appetizers instead of a higher priced entree.

So food is much more than sustenance for me. It's comfort, decadence, seduction, nutrition, joy...this is descending into an eating disorder, so let's get to the saving money part, shall we?

Eating at home, of course, will save you the most, but we all deserve a treat now and then. It is possible to enjoy dining out - occasionally - and still send your kids to college.

There are tons of online restaurant deals. My favorites are on Groupon and Travelzoo. I've purchased quite a number of delicious restaurant meals this way. It doesn't even take planning w/ Groupon. It has a "Now" deals section with discounts available right away. Consult your computer or smart phone and go. Everyone does this, and in my humble opinion we all need to get over feeling weird about it. The restaurants do this to get your business, so if you're there, it's a win win!

Now, these are not restaurants we budget watchers would normally visit, but whenever I can dine at Le Cirque, or Nobu or Bar Boulud for a $38 dinner tab I'm in. I had lunch today at Lincoln and it was divine!

When the schedule is first announced, I visit Open Table and make 3 or 4 Friday night dinner reservations. My boyfriend lives in New Jersey and comes into the city most weekends. Restaurant week menus are usually not available on Saturday night (but it never hurts to ask). Then I make a birthday dinner reservation for my daughter and/or son to take Mom out. Then I call traditional working friends to see if they are available for dinner during the week. And finally, I make a few lunch reservations and check in w/ my ladies who lunch.

Open Table makes it incredibly easy. You can change or cancel a reservation and then revue the meal when you're done. You earn points for this and earn a check good at any Open Table restaurant. Last Friday evening, I took my daughter our to a wonderful new restaurant that was participating in Restaurant Week. I used my $20 Open Table check when the bill came and without drinks two 3 course meals were less than $60!

In previous years, Restaurant Week has been held in Brooklyn, Long Island and Westchester. If you live there, you might want to put a "Restaurant Week" alert on your computer or smart phone so you won't

miss it.

Once you've dined, remember to review the restaurant to build up those reward points. If you are also willing to write something for Zagat, you will get a free one of this fantastic restaurant guide, too.

During non-Restaurant Weeks, look for prix fix and stick to the menu! The beverages and coffee add up quickly. I'm addicted to seltzer, but when I eat out, it's usually tap water, please. I ask for a wedge of lemon and I'm a happy girl! Lunch is always less expensive than dinner, and many restaurants have lunch specials to lure you in at this generally less crowded time of day. So meet a friend for lunch!

At dinner, for savings and health reasons, you can frequently take half of the meal home and have it the next day for lunch. Or there is nothing wrong with ordering 2 appetizers instead of a higher priced entree.

Finally, don't forget about Restaurant Trucks. You can get a very satisfying lunch at trucks serving yogurt, Jerk chicken, Halal delicacies, etc. Find your favorite cuisine here:

Next time, we'll talk about how to save food dollars at home. Bon appetite!

Keep calm & carry on...Lori

Next time, we'll talk about how to save food dollars at home. Bon appetite!

Keep calm & carry on...Lori